child tax credit september 2021 delay

The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17 years old. The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Did Your Advance Child Tax Credit Payment End Or Change Tas

Max refund is guaranteed and 100 accurate.

. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. IR-2021-188 September 15 2021. Ad Free means free and IRS e-file is included.

This isnt a problem to do. The Internal Revenue Service IRS sent out relief payments on September 15 worth up to 300 per child but more than 200 parents have complained they. Americans may be planning ahead as they know their tax situation may change and dont want.

The Internal Revenue Service said Sept. Payments began in July and will continue through December with the remaining. KTLA Another round of advance child tax credit payments is just days away from going out to tens of millions of Americans.

Sep 13 2021 0808 AM EDT. 17 that it was aware. Enter your information on Schedule 8812 Form.

Some eligible parents who are missing their September child tax credit payments should get them soon. The third batch of monthly. Parents may be saving up for a luxury holiday or they may want to pay off some bills according to CNET.

September 26 2021 103 PM. Get your advance payments total and number of qualifying children in your online account. While the latest installment of the 2021 Child Tax Credit payments was issued by the IRS on Sept.

Families may want to receive a bumper child tax credit next year once tax returns are filed in April. It will also let parents take advantage of any increased payments they. Families could receive child tax credit rebates for up to 250 per child under age 18 maxing out at three kids.

Some families have reported issues with child tax credit payments as well as tax returns and stimulus checks. HUNDREDS of parents across the United States are feeling frustrated with Septembers child tax credit as more than 30million families were expecting to receive the Covid relief money last week. At 300 per month for children under 6 years old and 250 for kids up to 11 years old the dollars add up.

One parent with four children told KDKA that he really misses the 1000 he was supposed. The expanded child tax credit pays up to 300 per child ages 5 and younger and up to 300 for children ages 6-17. To reconcile advance payments on your 2021 return.

This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now qualify for. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. The next Advanced Child Tax payment is due to go out on October 15th.

This third batch of advance monthly payments totaling about 15 billion is reaching about 35. The deadline for eligible families to opt out of receiving the 250 or 300 payment per eligible child is Monday October 4. However the IRS expected the delayed September child tax credit payments to hit bank accounts on Friday.

15 some families are getting anxious that they have yet to receive the money according to a. After the July and August payments the first two in the special 2021 child tax credit payment schedule were made on time the September one is taking longer for some. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The deadline to un-enroll is Monday October 4 at 1159pm. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Eligibility caps at 100000 income for a single filer household or.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

I Bond Dilemma Buy In October Or Wait Until November Treasury Inflation Protected Securities

Child Tax Credit 2021 Update November Stimulus Check Payment Date Is Next Week Ahead Of Final 300 Deadline

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Parents Of Children Born In 2021 Can Claim Stimulus As Tax Credit Wvns

What To Know About September Child Tax Credit Payments Forbes Advisor

When Parents Can Expect Their Next Child Tax Credit Payment

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

Update On 2021 Summer Ebt And Child Care P Ebt Kentucky Youth Advocates

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Last Chance To Get Advance Child Tax Credit Payment Arrives Nov 15 The Washington Post

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

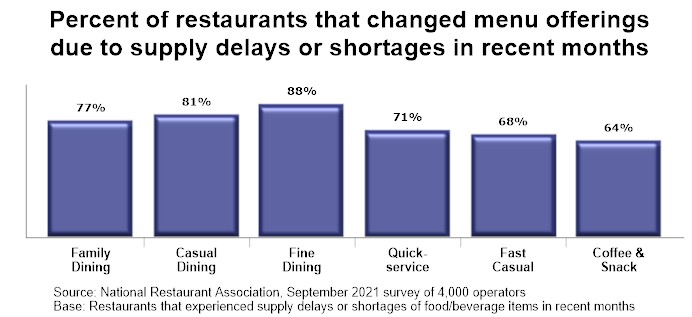

Rising Food Costs And Supply Chain Issues Are Creating Challenges National Restaurant Association

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities